QuickBooks Online Review: I recommend QuickBooks Online for small to medium-sized businesses seeking a comprehensive accounting solution with robust features and cloud accessibility. QuickBooks Online excels with its intuitive interface, extensive integration capabilities, and powerful reporting tools that streamline financial management. However, businesses should consider the subscription-based pricing model, potential internet dependency issues, and varying levels of customer support before committing to the platform.

Overview and Evolution

QuickBooks Online has established itself as a market-leading accounting solution in 2025. The platform continues to evolve with significant updates focused on practical improvements and enhanced functionality.

The latest version introduces over 150 updates in its recent release, emphasizing performance optimization and user experience enhancements. These improvements demonstrate Intuit’s commitment to refining core functionality rather than simply adding flashy features.

Cloud-based accessibility remains a cornerstone benefit, allowing users to manage finances from anywhere with an internet connection. This feature proves particularly valuable for businesses with remote teams or those requiring real-time collaboration with accountants.

The platform offers a tiered pricing structure to accommodate businesses at different growth stages. Plans range from basic options for solopreneurs to advanced solutions for larger organizations with complex accounting needs.

Key Features and Functionality

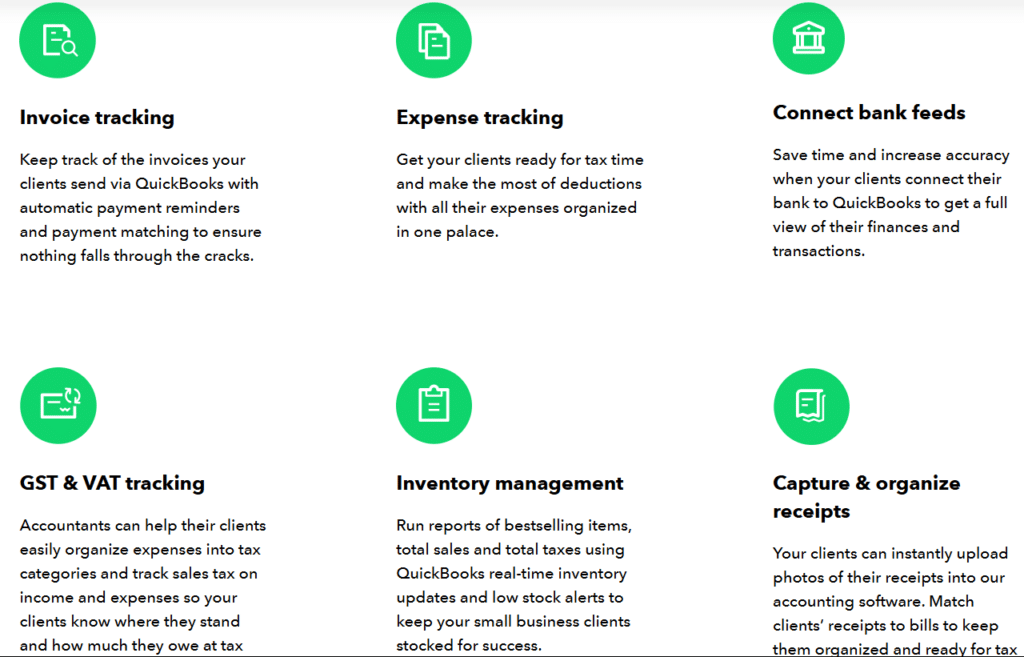

QuickBooks Online provides a comprehensive suite of accounting tools designed to streamline financial management. The platform handles everything from basic bookkeeping to advanced reporting and analysis.

The record-keeping capabilities allow for detailed transaction management with options to add reference numbers, permit numbers, attachments, and memos. This level of detail enhances reporting accuracy and provides deeper financial insights.

https://quickbooks.intuit.com/

Inventory management features in Plus and Advanced plans enable users to track inventory, set reorder points, create purchase orders, and manage vendors. The system also supports integration with third-party platforms like Amazon and Shopify for synchronized inventory management.

| Feature Category | Capabilities | Benefits |

| Record-Keeping | Detailed transaction entries, customizable fields, document attachments | Enhanced organization and audit readiness |

| Reporting | Custom reports, financial statements, tax summaries, business insights | Data-driven decision making and financial visibility |

| Invoicing | Customizable templates, recurring invoices, online payment acceptance | Improved cash flow and professional presentation |

| Expense Tracking | Receipt capture, categorization, mileage tracking, vendor management | Simplified tax preparation and expense control |

| Banking | Bank feed connections, transaction matching, reconciliation tools | Reduced manual entry and improved accuracy |

The platform’s AI-powered features have seen significant enhancements in 2025. Auto-categorization now recognizes and sorts common transactions, saving hours during reconciliation and improving data accuracy.

Mobile functionality allows users to manage their finances on the go through a well-designed app. Business owners can create invoices, capture receipts, and monitor financial performance from smartphones and tablets.

Pricing and Plans

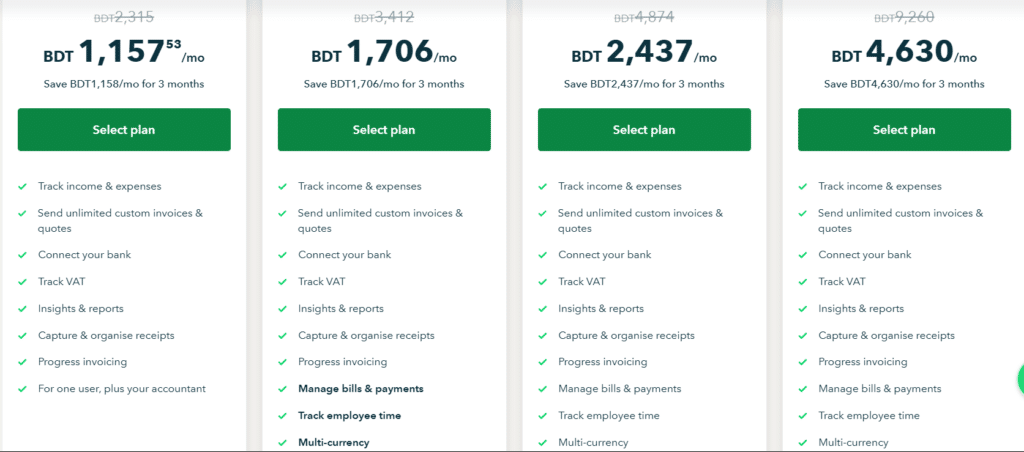

QuickBooks Online offers a tiered pricing structure with plans designed to meet the needs of different business sizes and complexities. Each tier provides progressively more advanced features and user capacity.

The Simple Start plan begins at $17.50 per month (with current promotions) and supports one user with basic accounting features. This entry-level option provides good value for sole proprietors and very small businesses.

Higher-tier plans include Essentials ($32.50/month), Plus ($49.50/month), and Advanced ($117.50/month), each offering additional features and supporting more users. The current promotion offers 50% off for the first three months.

| Plan | Monthly Price | Users | Key Features |

| Simple Start | $17.50 | 1 | Income/expense tracking, invoicing, basic reports |

| Essentials | $32.50 | 3 | Bill management, time tracking, multiple users |

| Plus | $49.50 | 5 | Inventory tracking, project profitability, budgeting |

| Advanced | $117.50 | 25 | Custom user permissions, business analytics, dedicated support |

Additional users beyond plan limits cost $11 per month each, which can significantly increase costs for growing businesses. This per-user pricing model requires careful consideration for companies with larger teams.

Payroll services are available as add-ons for an additional monthly fee plus per-employee costs. These services integrate seamlessly with the accounting platform but represent an additional expense beyond the base subscription.

Unlike the desktop version, QuickBooks Online requires a separate subscription for each company file or EIN. This approach can substantially increase costs for businesses managing multiple entities or separate financial records.

User Experience and Interface

QuickBooks Online features an intuitive interface that balances functionality with ease of use. The dashboard provides a clear overview of financial status with customizable widgets for quick access to important information.

Navigation has been streamlined in the 2025 version with the introduction of tailorable Quick Actions and improved organization of key functions. These enhancements help users access frequently used features more efficiently.

The new Sales Overview dashboard offers a visual display of income and improved access to sales-related functions. This update helps business owners better understand their revenue streams at a glance.

Mobile responsiveness ensures a consistent experience across devices, allowing users to manage finances from desktops, tablets, or smartphones. The mobile app maintains most functionality of the desktop version with an adapted interface for smaller screens.

Customization options allow users to tailor the platform to their specific needs. Personalized dashboards, custom reports, and configurable workflows help businesses optimize the system for their unique requirements.

The learning curve varies depending on previous accounting experience and familiarity with cloud-based software. New users may require some time to become proficient, while those transitioning from QuickBooks Desktop might need to adjust to the different interface and workflow.

Integration Capabilities

QuickBooks Online offers extensive integration options with over 750 third-party applications. This robust ecosystem allows businesses to create a connected technology stack that addresses specific industry needs.

Popular integration categories include e-commerce platforms, CRM systems, payment processors, and inventory management solutions. These connections reduce manual data entry and ensure consistent information across business systems.

| Integration Category | Number of Apps | Popular Examples |

| E-commerce | 50+ | Shopify, WooCommerce, Amazon |

| Payment Processing | 30+ | PayPal, Stripe, Square |

| CRM | 40+ | Salesforce, HubSpot, Zoho |

| Time Tracking | 25+ | TSheets, Harvest, Toggl |

| Inventory Management | 20+ | SOS Inventory, DEAR Systems |

Google Drive integration has been added in 2025, allowing users to upload receipts directly from their Google Drive to attach to transactions. This feature streamlines document management and improves record-keeping.

The platform’s API enables custom integrations for businesses with specialized needs. This flexibility allows for connections with proprietary systems or niche applications not available in the app marketplace.

Integration with Microsoft Office facilitates data export to Excel for advanced analysis and the creation of custom reports. This compatibility enhances the platform’s reporting capabilities beyond built-in options.

Pros and Cons

Pros

- Cloud-based accessibility enables users to manage finances from anywhere with an internet connection, supporting remote work and collaboration.

- Extensive integration ecosystem with over 750 third-party applications allows businesses to create a connected technology stack.

- Automated features like transaction categorization, recurring invoices, and payment reminders save time and reduce manual data entry.

- Robust reporting capabilities provide detailed insights into business performance with customizable reports and dashboards.

- Regular updates and improvements ensure the platform remains current with evolving business needs and technological advancements.

- Mobile functionality through a well-designed app allows for on-the-go financial management and receipt capture.

Cons

- Subscription-based pricing can become expensive over time, particularly for businesses with multiple entities or users.

- Internet dependency means service interruptions or poor connectivity can temporarily prevent access to financial data.

- Customer support quality receives mixed reviews, with some users reporting long wait times and inconsistent assistance.

- Feature limitations compared to the desktop version may affect businesses with specialized needs or complex workflows.

- Learning curve for new users or those transitioning from QuickBooks Desktop requires time investment to become proficient.

- Payroll integration requires additional subscription fees, increasing the overall cost for businesses needing this functionality.

QuickBooks Online vs. Competitors

When compared to other accounting platforms, QuickBooks Online demonstrates distinct strengths and limitations. Understanding these differences helps businesses select the most appropriate solution for their specific needs.

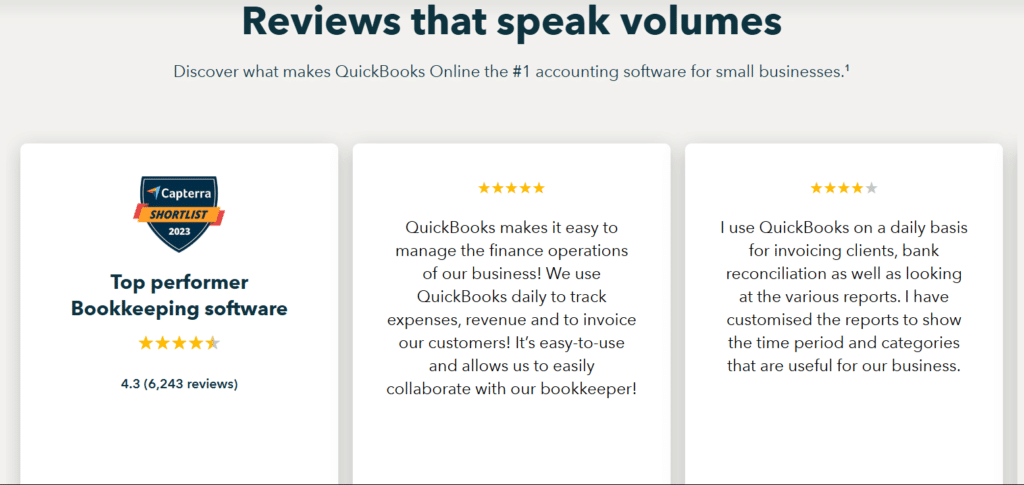

Xero represents a strong competitor with a user-friendly interface and growing market presence. While QuickBooks Online offers more integrations (750+ vs. Xero’s smaller ecosystem), Xero receives higher average user ratings for ease of use (4.2/5 compared to QBO’s 4.1/5).

| Feature | QuickBooks Online | Xero | FreshBooks |

| Starting Price | $17.50/month | Higher entry point | $19/month |

| Integrations | 750+ | Fewer options | 149 |

| User Interface | Good | Excellent | Very Good |

| Reporting | Extensive | Good with customization | Limited |

| Scalability | High | High | Moderate |

| Target Audience | All business sizes | Growing businesses | Freelancers/Small businesses |

FreshBooks targets freelancers and small businesses with a more focused feature set. QuickBooks Online offers more comprehensive accounting capabilities but at a higher price point and potentially greater complexity.

Desktop accounting solutions provide alternatives for businesses concerned about internet dependency or subscription costs. However, these options lack the accessibility and automatic updates of cloud-based platforms.

For larger enterprises, more advanced systems like Sage Intacct or NetSuite may provide better solutions with more robust features for complex business structures. QuickBooks Online is generally most suitable for small to medium-sized businesses.

Time-Saving Tools and Automation

QuickBooks Online has significantly enhanced its automation capabilities in the 2025 version. These features reduce manual tasks and improve efficiency for busy business owners and accounting professionals.

The enhanced auto-categorization feature now recognizes and sorts common transactions automatically. This AI-powered tool learns from previous categorizations to improve accuracy over time, saving hours during reconciliation.

Recurring transaction setup allows users to automate regular invoices, bills, and other transactions. This feature ensures consistent timing and accuracy for predictable financial activities without manual intervention.

| Automation Feature | Function | Time Saved |

| Auto-Categorization | Automatically sorts transactions based on historical patterns | 3-5 hours monthly |

| Recurring Transactions | Schedules regular invoices, bills, and payments | 2-4 hours monthly |

| Bank Feed Connections | Automatically imports transactions from financial institutions | 4-6 hours monthly |

| Payment Reminders | Sends automatic notifications to customers with outstanding balances | 1-3 hours monthly |

| Report Scheduling | Automatically generates and distributes regular reports | 2-3 hours monthly |

Custom workflows in QuickBooks Online Advanced allow businesses to automate basic, repetitive tasks based on specific triggers and conditions. This feature enables personalized automation beyond standard options.

Mobile receipt capture streamlines expense tracking by allowing users to photograph receipts that are then automatically processed and categorized. This reduces paper handling and manual data entry for expense management.

Automated bank reconciliation matches imported transactions with those recorded in the system, highlighting discrepancies that require attention. This process significantly reduces the time required for monthly reconciliation tasks.

My Opinion

After analyzing QuickBooks Online’s features, performance, and user feedback in 2025, I believe the platform represents an excellent accounting solution for most small to medium-sized businesses. The combination of robust features, cloud accessibility, and extensive integration options creates a powerful tool for financial management.

The platform’s commitment to continuous improvement is evident in the recent updates focused on enhancing core functionality and user experience. These practical improvements demonstrate a focus on solving real business challenges rather than simply adding flashy features.

For businesses transitioning from spreadsheets or basic accounting methods, QuickBooks Online offers a significant upgrade in capabilities and efficiency. The automation features alone can save hours of manual work each month, justifying the subscription cost for many users.

However, the pricing structure requires careful consideration, particularly for businesses with multiple entities or users. The per-company and per-user fees can add up quickly, potentially making alternative solutions more economical for certain business structures.

The mixed reviews regarding customer support quality represent a concern that prospective users should evaluate. While many users report positive experiences, others describe frustrating interactions and long wait times for assistance.

Overall, QuickBooks Online remains a market leader for good reason, offering a balanced combination of functionality, accessibility, and reliability. For most small to medium businesses seeking a comprehensive accounting solution, the platform provides excellent value despite its limitations.

FAQ

Q: What are the main differences between QuickBooks Online and QuickBooks Desktop in 2025?

A: QuickBooks Online is cloud-based with monthly subscription pricing, allowing access from any device with internet connection and automatic updates. QuickBooks Desktop requires a one-time purchase with optional annual updates, runs locally on your computer, offers more advanced inventory features, and allows multiple company files under one purchase. Online excels in accessibility and collaboration, while Desktop provides more customization options and potentially lower long-term costs.

Q: Does QuickBooks Online work well for specific industries?

A: QuickBooks Online works well for service-based businesses, retail, e-commerce, and professional services. The 2025 version has introduced more tailored features for industries like construction, manufacturing, and retail. However, businesses with complex inventory needs or specialized industry requirements may find the desktop version or industry-specific accounting software more suitable.

Q: How secure is QuickBooks Online for financial data?

A: QuickBooks Online provides top-tier security features with built-in compliance tools for data privacy regulations. The 2025 version includes enhanced multi-factor authentication (MFA) and data encryption protocols to protect sensitive information. Data is stored in secure data centers with regular backups, though users should still maintain good security practices like strong passwords and careful user permission management.

Q: Can multiple users access QuickBooks Online simultaneously?

A: Yes, multiple users can access QuickBooks Online simultaneously based on your subscription plan. The Simple Start plan allows 1 user, Essentials supports 3 users, Plus accommodates 5 users, and Advanced allows up to 25 users. Additional users can be added for $11 per month each. Each user can be assigned specific permission levels to control access to sensitive financial information.

Q: How does QuickBooks Online handle multi-company management?

A: Unlike QuickBooks Desktop, QuickBooks Online requires a separate subscription for each company file or EIN. This approach can increase costs for businesses managing multiple entities. However, the 2025 version has introduced improved organization and roles management, allowing businesses to group multiple stores under one organization, which simplifies staff management and billing even with separate subscriptions.

Q: What automation features does QuickBooks Online offer in 2025?

A: QuickBooks Online 2025 offers several automation features including enhanced auto-categorization of transactions, recurring transaction scheduling, automated payment reminders, bank feed connections with automatic transaction imports, report scheduling, and custom workflows (in Advanced plan). These features significantly reduce manual data entry and streamline accounting processes, saving users several hours of work each month.