I recommend QuickBooks Online for small business owners seeking a user-friendly, feature-rich accounting solution in 2025. QuickBooks Online delivers an intuitive interface, robust automation tools, and comprehensive financial management capabilities that streamline accounting tasks even for users without financial backgrounds. The software offers excellent bank integration, powerful reporting, and the new Intuit Assist AI feature that provides personalized guidance. While the pricing increases after promotional periods and some users find certain features limited, the overall value, time savings, and financial insights make it worth the investment for most small businesses.

QuickBooks Online in 2025

QuickBooks Online has established itself as a leading cloud-based accounting solution for businesses of all sizes. The platform enables users to manage their finances efficiently through an intuitive interface accessible from anywhere with internet connectivity.

Recent updates in 2025 have enhanced QuickBooks Online with improved AI capabilities through Intuit Assist and more streamlined automation features. These improvements strengthen its position as a top accounting solution for modern businesses seeking efficiency and accuracy.

The software operates entirely in the cloud, eliminating the need for local installations or manual updates. This cloud-based approach ensures users always access the latest version with current security protections and regulatory compliance features.

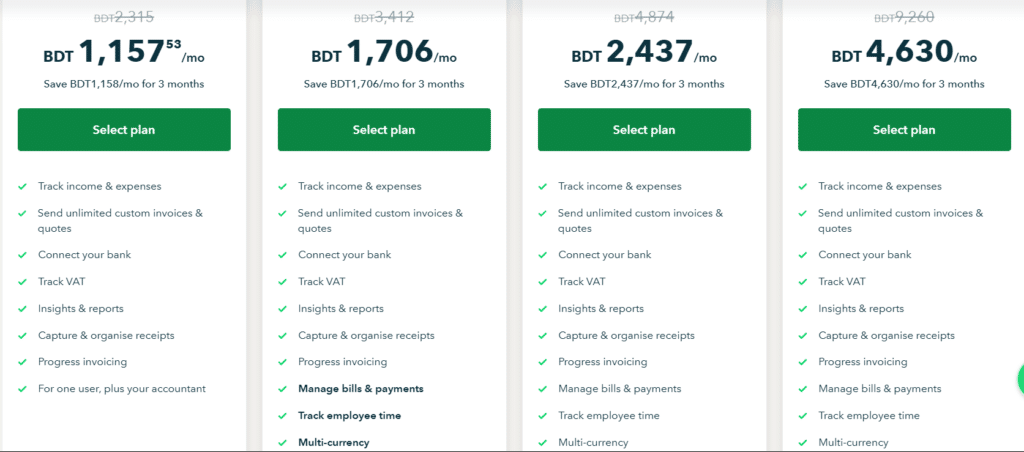

QuickBooks Online offers several plans to accommodate businesses at different stages of growth. The platform provides Simple Start, Essentials, Plus, and Advanced tiers with increasing features and capabilities to match your business needs.

Choosing the Right QuickBooks Online Plan

QuickBooks Online Simple Start serves as the entry-level option for very small businesses and solopreneurs. The plan includes basic features like income and expense tracking, invoice and payment processing, and tax deduction categorization.

QuickBooks Online Essentials builds upon the Simple Start plan with additional capabilities. The system adds bill management, time tracking, and multiple user access (up to 3 users) for growing businesses.

QuickBooks Online Plus provides more advanced features for established small businesses. The plan includes inventory tracking, project profitability monitoring, and budget creation tools that help businesses manage more complex operations.

QuickBooks Online Advanced delivers enterprise-level features for larger small businesses. The system offers batch invoicing, custom user permissions, enhanced reporting, and dedicated account support for businesses with sophisticated needs.

| Plan | Price | Users | Key Features | Best For |

|---|---|---|---|---|

| Simple Start | $15/month | 1 | Basic accounting, invoicing | Freelancers, startups |

| Essentials | $30/month | 3 | Bill management, time tracking | Service businesses |

| Plus | $40/month | 5 | Inventory, project tracking | Product-based businesses |

| Advanced | $90/month | 25+ | Batch operations, custom fields | Larger small businesses |

Setting Up Your QuickBooks Online Account

The account creation process begins with visiting the QuickBooks website and selecting a plan. The system guides you through providing basic information about your business and creating login credentials.

Many users can take advantage of promotional pricing and free trial offers. QuickBooks typically offers a 30-day free trial that allows you to explore the platform before committing to a subscription.

The initial setup wizard walks you through essential configuration steps. This guided process helps you customize QuickBooks for your specific business type and industry.

Company information setup requires entering your business name, address, tax identification numbers, and other basic details. This information appears on invoices and financial documents created through the system.

Chart of accounts configuration establishes the financial framework for your business. QuickBooks automatically creates a standard chart of accounts based on your industry, which you can customize to match your specific needs.

Connecting Your Bank Accounts

Bank account integration represents one of QuickBooks Online’s most powerful features. The platform connects securely to your financial institutions to automatically import transactions.

The connection process requires providing your online banking credentials through a secure interface. QuickBooks uses bank-level security protocols to protect your sensitive information during this process.

Transaction categorization happens automatically based on patterns and rules. The system learns from your categorization choices to improve accuracy over time, reducing manual data entry.

Bank rules creation helps streamline recurring transactions. You can establish rules that automatically categorize specific transactions based on vendors, amounts, or descriptions.

Historical transaction importing allows you to bring in past financial data. QuickBooks typically imports 90 days of transaction history, though you can manually import older transactions if needed.

| Bank Integration Step | Purpose | Benefit |

|---|---|---|

| Connect Accounts | Link bank and credit cards | Automated transaction import |

| Review Transactions | Verify categorization | Ensure accuracy |

| Create Rules | Automate recurring items | Save time on data entry |

| Reconcile Accounts | Match transactions | Maintain accurate records |

| Manage Multiple Accounts | Centralize financial data | Complete financial picture |

Setting Up Customers and Vendors

Customer profiles store essential information about your clients. The system maintains contact details, payment terms, tax settings, and transaction history for each customer.

Vendor information management works similarly to customer profiles. You can store contact information, payment terms, and transaction history for each supplier or service provider.

Product and service items creation establishes your sales catalog. You can define items with descriptions, prices, and tax settings that populate automatically when creating invoices.

Default payment terms configuration streamlines invoicing. Setting standard payment terms (like Net 30) for customers saves time when creating new invoices and helps maintain consistency.

Customer opening balances entry ensures accurate accounting from day one. You can enter any outstanding customer balances to maintain continuity when transitioning from another system.

Creating and Managing Invoices

Invoice customization allows you to reflect your brand identity. QuickBooks offers templates that you can modify with your logo, color scheme, and preferred layout.

The invoice creation process follows a straightforward workflow. You select a customer, add products or services, apply any discounts or taxes, and set payment terms to generate a professional invoice.

Recurring invoice setup automates regular billing. For subscription services or retainer arrangements, you can configure invoices to generate and send automatically on a specified schedule.

Payment processing integration facilitates faster collections. QuickBooks can connect with payment processors to enable online payments directly from invoices, improving cash flow.

Invoice tracking provides visibility into payment status. The system shows which invoices are paid, outstanding, or overdue, helping you manage accounts receivable effectively.

Managing Expenses and Bills

Expense entry can happen manually or through bank feeds. The system allows you to record expenses directly or categorize them as they import from your connected accounts.

Receipt capture functionality streamlines expense documentation. The mobile app lets you photograph receipts, which QuickBooks then processes to extract and record the relevant information.

Bill management features help track money owed to vendors. You can enter bills, schedule payments, and monitor accounts payable to maintain good supplier relationships.

Expense categorization ensures accurate financial reporting. Properly categorized expenses provide insights into spending patterns and facilitate tax preparation.

Payment scheduling helps manage cash flow effectively. You can schedule bill payments to ensure timely remittance while maintaining optimal cash positions.

| Expense Management Feature | Capability | Benefit |

|---|---|---|

| Receipt Capture | Mobile photo processing | Paperless record-keeping |

| Bill Tracking | Accounts payable management | Avoid missed payments |

| Expense Categories | Customizable classification | Better financial analysis |

| Vendor Management | Centralized supplier data | Streamlined purchasing |

| Payment Scheduling | Timed bill payments | Improved cash flow control |

Running Reports and Analytics

Financial statement generation happens with a few clicks. QuickBooks can instantly produce profit and loss statements, balance sheets, and cash flow reports for any date range.

Tax preparation reports simplify year-end processes. The system provides reports specifically designed to facilitate tax filing, saving time and reducing errors.

Sales analysis helps identify business trends. Reports showing sales by customer, product, or time period reveal patterns that can inform business decisions.

Expense reports provide insights into spending patterns. These reports help identify areas where costs might be reduced or better managed.

Custom report creation allows for tailored financial analysis. You can design reports with specific parameters to address unique business questions or requirements.

Using QuickBooks Mobile App

The mobile app extends functionality to smartphones and tablets. Business owners can perform essential tasks from anywhere, increasing productivity and responsiveness.

Invoice creation on the go allows for immediate billing. You can create and send invoices directly after completing work, accelerating the payment cycle.

Receipt capture streamlines expense documentation. The app lets you photograph receipts, which are then processed and recorded in your QuickBooks account.

Dashboard access provides financial visibility anywhere. You can check key metrics and account balances even when away from your computer.

Payment processing enables immediate transaction recording. You can record payments received in the field, maintaining current and accurate financial records.

Leveraging Intuit Assist AI in 2025

Intuit Assist represents a significant advancement in QuickBooks Online for 2025. The AI-powered assistant provides personalized guidance and automation throughout the platform.

Financial insights generation happens automatically through AI analysis. The system identifies trends, anomalies, and opportunities in your financial data without manual analysis.

Invoice creation assistance streamlines billing processes. Intuit Assist can help draft invoices based on historical patterns and current information.

Expense categorization becomes more accurate with AI assistance. The system learns from your patterns to suggest increasingly accurate expense classifications.

Question answering capabilities provide on-demand guidance. You can ask Intuit Assist questions about your finances or how to perform specific tasks within QuickBooks.

| AI Feature | Capability | Benefit |

|---|---|---|

| Financial Insights | Automated data analysis | Identify trends and opportunities |

| Content Generation | Draft invoices and reports | Save time on routine tasks |

| Smart Categorization | Learning-based suggestions | Improve accuracy over time |

| Natural Language Q&A | Answer financial questions | On-demand guidance |

| Anomaly Detection | Identify unusual transactions | Prevent errors and fraud |

Integrating with Other Business Tools

Payment processor connections facilitate online payments. QuickBooks integrates with popular payment services to enable electronic payment acceptance.

E-commerce platform integration streamlines sales recording. Connections with platforms like Shopify automatically import sales transactions into QuickBooks.

Payroll system connections simplify employee compensation. QuickBooks can integrate with payroll services to maintain comprehensive financial records.

CRM integration enhances customer relationship management. Connecting with CRM systems provides a more complete view of customer interactions and finances.

Time tracking tool connections improve project profitability analysis. Integration with time tracking systems helps accurately allocate labor costs to projects.

Troubleshooting Common Issues

Bank connection problems can usually be resolved through reconnection. If transactions stop importing, refreshing the connection often resolves the issue.

Categorization errors correction maintains accurate records. You can easily recategorize transactions that QuickBooks has misclassified.

Duplicate transaction management prevents double-counting. The system identifies potential duplicates, which you can then merge or delete as appropriate.

Data reconciliation resolves discrepancies between QuickBooks and bank statements. The reconciliation process helps ensure your financial records match actual account balances.

Support resources provide assistance for technical issues. QuickBooks offers extensive documentation, community forums, and direct support options for resolving problems.

Best Practices for QuickBooks Online

Regular reconciliation ensures accurate financial records. Reconciling accounts monthly helps catch errors early and maintains the integrity of your financial data.

Consistent categorization improves reporting accuracy. Using consistent categories for transactions provides more meaningful financial insights over time.

Backup data protection safeguards your financial information. While QuickBooks Online automatically backs up your data, exporting regular backups provides additional security.

User permission management controls information access. Assigning appropriate permissions to different users helps protect sensitive financial data.

Regular review of financial reports identifies business trends. Consistent analysis of key reports helps you spot opportunities and address issues proactively.

My Opinion on QuickBooks Online in 2025

After thoroughly analyzing QuickBooks Online’s features and user experiences in 2025, I believe the platform represents an excellent choice for small to medium-sized businesses seeking comprehensive accounting software. The combination of intuitive interface, powerful features, and new AI capabilities creates a compelling package for businesses looking to streamline their financial management.

QuickBooks Online’s strongest advantages include its user-friendly design, robust automation capabilities, and excellent integration options. The platform’s automation tools eliminate tedious tasks and reduce errors, while the clean interface makes it accessible even for users without accounting backgrounds.

The introduction of Intuit Assist in recent updates provides significant value through AI-powered insights and assistance. This feature helps business owners understand their finances better and make more informed decisions without requiring advanced accounting knowledge.

For growing businesses, QuickBooks Online’s scalable plans provide a clear upgrade path as needs evolve. The tiered approach ensures businesses only pay for the features they need while maintaining the option to access more advanced capabilities when required.

The main limitations include somewhat higher pricing after promotional periods end and occasional limitations in certain advanced features. Businesses with very specific industry needs might find some specialized functions lacking compared to industry-specific solutions.

Overall, QuickBooks Online delivers exceptional value through its combination of comprehensive features, automation capabilities, and intuitive design. For most small to medium-sized businesses, the platform provides all the accounting functionality needed with a user experience that respects the time constraints of busy business owners.

FAQ

Q: How much does QuickBooks Online cost in 2025?

A: QuickBooks Online offers several pricing tiers in 2025, starting with the Simple Start plan at approximately $15 per month, Essentials at $30 per month, Plus at $40 per month, and Advanced at $90 per month. These prices reflect promotional rates, with regular pricing typically higher. QuickBooks frequently offers discounts for the first few months of service, and a 30-day free trial is available for new users to test the platform before committing to a subscription.

Q: Is QuickBooks Online difficult to learn for beginners?

A: QuickBooks Online is designed to be user-friendly even for those without accounting backgrounds. The software features an intuitive interface that most users can learn relatively quickly. The setup process includes guided wizards that walk you through essential configuration steps, and the dashboard presents information in a clear, visual format. While mastering all features may take time, most users can handle basic functions like invoicing, expense tracking, and running simple reports within a few days of starting. QuickBooks also offers extensive tutorials, help articles, and the new Intuit Assist AI feature to provide guidance when needed.

Q: Can QuickBooks Online handle inventory management?

A: Yes, QuickBooks Online can handle inventory management, but this feature is only available in the Plus and Advanced plans. The inventory management system allows you to track stock levels, set reorder points, and monitor the value of your inventory. The system automatically updates inventory counts when you record sales or purchases, maintaining accurate stock levels without manual adjustments. While sufficient for many small businesses, companies with very complex inventory needs or manufacturing processes might require more specialized inventory software or additional integrations.

Q: How does QuickBooks Online handle bank transactions?

A: QuickBooks Online handles bank transactions through secure connections with your financial institutions. After linking your accounts, the system automatically imports transactions daily, typically going back 90 days initially. QuickBooks uses machine learning to categorize transactions based on previous patterns, though you’ll need to review these categorizations for accuracy. You can create rules to automatically categorize recurring transactions, significantly reducing manual data entry. The platform also includes reconciliation tools to ensure your QuickBooks records match your actual bank statements, helping maintain accurate financial records.

Q: What reports can I generate with QuickBooks Online?

A: QuickBooks Online offers a comprehensive range of reports to help you understand your business finances. Standard financial reports include profit and loss statements, balance sheets, and cash flow reports that can be generated for any date range. The platform also provides specialized reports for accounts receivable aging, accounts payable, sales by customer or product, expense reports, and tax preparation. Plus and Advanced plans offer more sophisticated reporting options, including project profitability and inventory valuation. Most reports can be customized to show exactly the information you need, and you can save custom report configurations for future use.

Q: Can multiple users access my QuickBooks Online account?

A: Yes, QuickBooks Online supports multiple users, with the number varying by subscription tier. The Simple Start plan allows one user plus accountant access, Essentials supports up to three users, Plus allows up to five users, and Advanced accommodates 25+ users. You can assign different permission levels to each user, controlling what information they can view or edit. This feature allows you to give your accountant access to financial data while limiting sensitive information for other team members. The Advanced plan offers the most granular permission controls, allowing you to customize access for specific functions or reports.

Q: How does the new Intuit Assist AI feature work in QuickBooks Online?

A: Intuit Assist, introduced in recent updates, is an AI-powered assistant integrated throughout QuickBooks Online. The feature provides personalized guidance based on your business data and usage patterns. Intuit Assist can help analyze your financial data to identify trends and anomalies, assist with creating invoices and categorizing expenses, and answer questions about your finances or how to use specific QuickBooks features. The AI uses natural language processing to understand your questions and provides contextual responses based on your actual business data. This feature is particularly helpful for users without accounting backgrounds, as it can explain financial concepts and provide actionable insights in plain language.