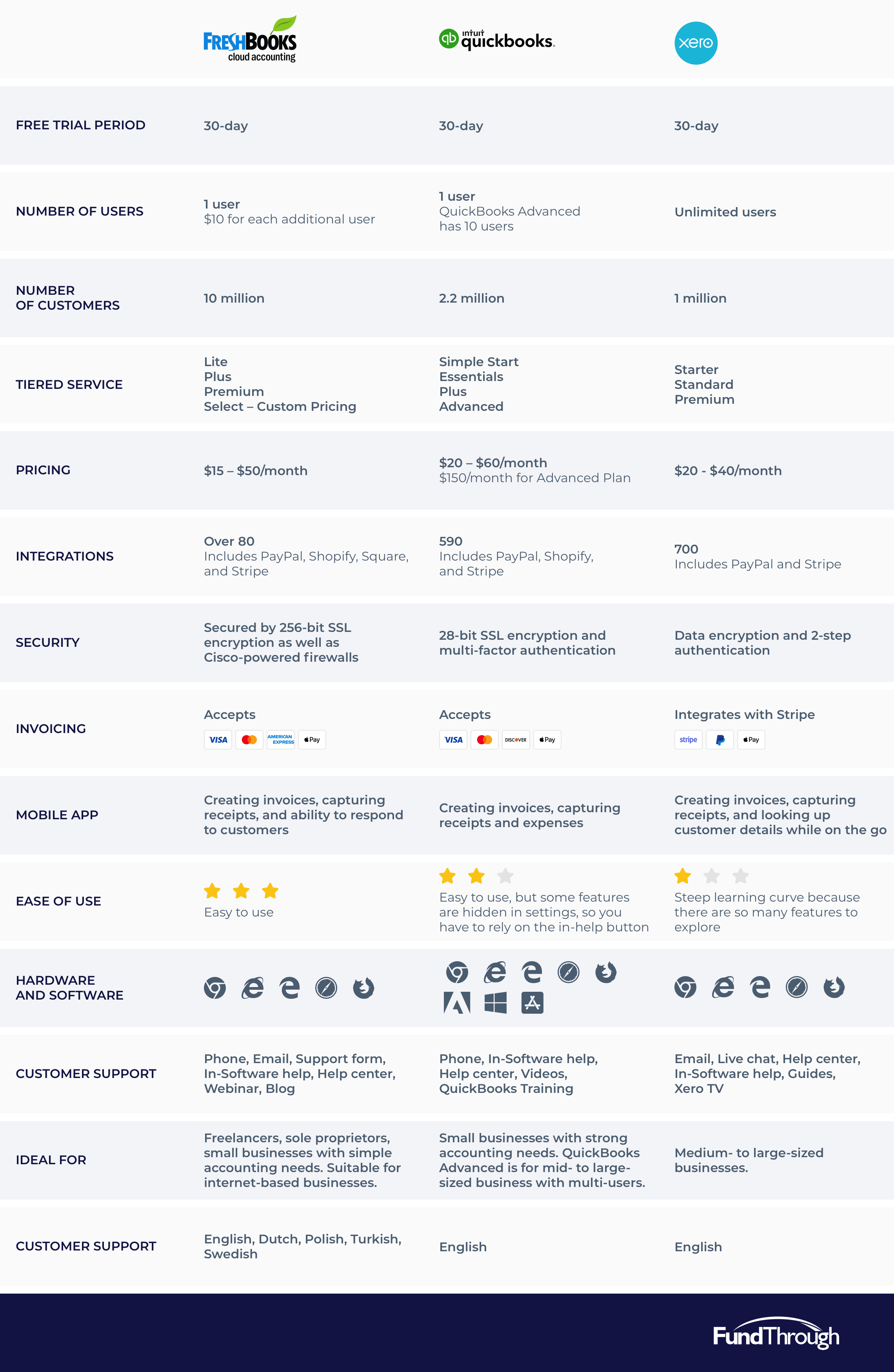

Choosing the right accounting software can be challenging. Freshbooks, Quickbooks, and Xero are popular options.

Freshbooks Vs Quickbooks Vs Xero, comparing these three helps you find the best fit for your business needs. Each software offers unique features, pricing, and user experience. Small business owners, freelancers, and accountants often debate which one is superior. Our goal is to simplify this decision for you.

We’ll provide a clear comparison of Freshbooks, Quickbooks, and Xero. This guide will help you understand their strengths and weaknesses. By the end, you’ll know which software aligns best with your requirements. Let’s dive into the details and make your decision easier.

Credit: https://www.accountingmississauga.ca/

Features Comparison

Choosing the right accounting software can be a complex task. FreshBooks, QuickBooks, and Xero offer various features. Understanding these features helps in making an informed decision. Below is a comparison of their core features.

Invoicing

FreshBooks offers customizable invoicing templates. Users can add their logo and adjust colors. It supports automatic billing and late payment reminders. QuickBooks provides professional invoice templates. Users can set up recurring invoices and accept payments online. Xero allows users to create and send invoices from any device. Invoices can be customized and sent in bulk.

Expense Tracking

FreshBooks simplifies expense tracking with receipt scanning. Users can categorize expenses and track time. QuickBooks offers expense management with receipt capture. It auto-categorizes expenses and syncs with bank accounts. Xero provides expense tracking with a mobile app. Users can photograph receipts and claim expenses instantly.

Reporting

FreshBooks generates basic financial reports. Users can view profit and loss statements. QuickBooks offers a wide range of detailed reports. Users can customize reports and track performance. Xero provides over 50 types of reports. Users can track cash flow and set budgets.

Ease Of Use

Choosing the right accounting software can be challenging. Freshbooks, Quickbooks, and Xero are popular choices. One key factor to consider is ease of use. This can make your accounting tasks smoother and more efficient. Let’s dive into the user interface and learning curve of each software.

User Interface

The user interface plays a crucial role in making software easy to use. Here’s a comparison of Freshbooks, Quickbooks, and Xero:

| Software | Design | Navigation |

|---|---|---|

| Freshbooks | Sleek and modern | Simple menus and clear icons |

| Quickbooks | Professional and organized | Dashboard with key features upfront |

| Xero | Clean and minimalist | Intuitive layout with easy access |

Learning Curve

Understanding how quickly you can learn and use the software is essential. Here’s what you need to know:

- Freshbooks: Designed for small businesses with no accounting background. Easy tutorials and customer support available.

- Quickbooks: Offers a range of features, which may require some time to master. Online resources and training available.

- Xero: User-friendly for beginners. Offers step-by-step guides and a supportive community.

Pricing Plans

Choosing the right accounting software can be challenging. Pricing plans play a significant role in decision-making. Freshbooks, Quickbooks, and Xero offer different plans to cater to various needs. Let’s explore the pricing structure of each.

Subscription Tiers

Freshbooks provides four tiers: Lite, Plus, Premium, and Select. Lite starts at $15 per month for freelancers and small businesses. Plus costs $25 per month, and Premium is $50 per month. Select is a custom plan for larger needs.

Quickbooks offers four tiers as well: Simple Start, Essentials, Plus, and Advanced. Simple Start is priced at $25 per month. Essentials costs $50 per month, Plus is $80 per month, and Advanced is $180 per month.

Xero has three subscription tiers: Early, Growing, and Established. Early starts at $12 per month. Growing is $34 per month, and Established is $65 per month.

Value For Money

Freshbooks is user-friendly with excellent customer support. The Lite plan is affordable for small businesses. Plus and Premium plans offer more features as your business grows.

Quickbooks is robust and offers comprehensive tools. The Simple Start plan is cost-effective for basic needs. Advanced plan provides extensive features for larger businesses.

Xero offers unlimited users in all plans. The Early plan is budget-friendly. Growing and Established plans offer more advanced features at a reasonable price.

Credit: www.fundthrough.com

Customer Support

Choosing the right accounting software involves many factors. One crucial aspect is customer support. Let’s compare FreshBooks, QuickBooks, and Xero based on their support options, response times, and overall quality.

Support Channels

| Software | Support Channels |

|---|---|

| FreshBooks |

|

| QuickBooks |

|

| Xero |

|

Response Time

Response time is crucial for resolving issues quickly. Here’s how each software performs:

- FreshBooks: Phone support usually connects within minutes. Email responses take about 24 hours.

- QuickBooks: Phone support can have long wait times. Live chat usually responds within 10 minutes. Email responses may take up to 48 hours.

- Xero: Email support responds within 24 hours. Live chat is quick, usually under 5 minutes.

In summary, all three options offer robust support. FreshBooks excels in quick phone support. QuickBooks offers a community forum for peer assistance. Xero stands out with its fast live chat responses.

Integrations

Choosing the right accounting software often depends on its ability to integrate with other tools. Integrations can streamline your workflow and improve efficiency. Freshbooks, Quickbooks, and Xero each offer various integration options that can help your business run smoothly.

Third-party Apps

Freshbooks integrates with over 100 apps, including popular tools like Slack and Zapier. These integrations can enhance your project management and communication processes.

Quickbooks boasts a larger ecosystem with over 650 third-party apps. This includes CRM systems, payment processors, and marketing tools. Quickbooks’ extensive app marketplace makes it highly versatile.

Xero offers more than 800 integrations. Its strong suit lies in e-commerce and inventory management apps. This makes Xero a solid choice for businesses needing robust inventory solutions.

| Software | Number of Integrations | Key Integration Types |

|---|---|---|

| Freshbooks | 100+ | Project management, Communication |

| Quickbooks | 650+ | CRM, Payment processing, Marketing |

| Xero | 800+ | E-commerce, Inventory management |

Bank Feeds

Freshbooks supports automatic bank feeds. This feature allows you to sync your bank transactions directly with your accounting software. It supports most major banks and financial institutions.

Quickbooks excels in bank feed integration. It offers real-time updates and supports a vast number of banks. This makes it easier to keep your financial records current.

Xero also provides strong bank feed capabilities. Its automatic bank feeds help you reconcile accounts effortlessly. Xero supports multiple currencies, which is ideal for businesses with international transactions.

| Software | Bank Feed Capability | Unique Feature |

|---|---|---|

| Freshbooks | Automatic sync with major banks | Supports most financial institutions |

| Quickbooks | Real-time updates | Extensive bank support |

| Xero | Automatic sync | Multi-currency support |

Credit: www.facebook.com

Mobile Accessibility

Mobile Accessibility has become a crucial aspect of accounting software. Users need to manage their finances on the go. Freshbooks, Quickbooks, and Xero all offer mobile apps. But how do they compare in terms of accessibility?

Mobile App Features

Each app offers unique features. Here’s a breakdown:

| Feature | Freshbooks | Quickbooks | Xero |

|---|---|---|---|

| Invoicing | Yes | Yes | Yes |

| Expense Tracking | Yes | Yes | Yes |

| Time Tracking | Yes | Yes | No |

| Project Management | Yes | No | No |

| Reporting | Limited | Comprehensive | Comprehensive |

Performance On Devices

Performance is key for mobile apps. Here’s how each app performs:

- Freshbooks: Known for its smooth performance. Works well on both iOS and Android.

- Quickbooks: Performs reliably. Some users report occasional lags on Android.

- Xero: Offers stable performance. Highly rated for its user-friendly interface.

Choosing the right app depends on your specific needs. Freshbooks excels in project management. Quickbooks is strong in reporting. Xero offers a user-friendly experience with stable performance.

Pros And Cons

Choosing the right accounting software can be challenging. Each has its own strengths and weaknesses. Let’s explore the pros and cons of Freshbooks, Quickbooks, and Xero to help you make an informed decision.

Freshbooks

Freshbooks is popular among freelancers and small business owners. It offers a user-friendly interface and excellent customer support.

- Pros:

- Easy to use

- Great for invoicing

- Excellent customer support

- Cons:

- Limited features for larger businesses

- Higher cost for additional users

- Less robust reporting

Quickbooks

Quickbooks is a well-known accounting tool. It is ideal for small to medium-sized businesses. It offers a wide range of features.

- Pros:

- Comprehensive features

- Widely used and trusted

- Integrates with many apps

- Cons:

- Steeper learning curve

- Higher price point

- Customer support can be slow

Xero

Xero is a strong contender in the accounting software market. It is known for its cloud-based features and scalability.

- Pros:

- Cloud-based and accessible

- Scalable for growing businesses

- Multi-currency support

- Cons:

- Complex for beginners

- Limited customer support

- Fewer integrations than Quickbooks

Best Fit For Businesses

Choosing the right accounting software is crucial for any business. FreshBooks, QuickBooks, and Xero are three popular options. Each one caters to different types of businesses. Understanding which software fits best can save time and resources.

Small Businesses

FreshBooks is ideal for small businesses. It offers simple invoicing and expense tracking. FreshBooks also provides time tracking and project management tools. These features are user-friendly. QuickBooks is another great option for small businesses. It offers more advanced features than FreshBooks. These include payroll and inventory management. Xero is also suitable for small businesses. It provides strong banking and reconciliation features. Xero also integrates with many third-party apps.

Medium-sized Businesses

QuickBooks is a top choice for medium-sized businesses. It offers advanced features like payroll and inventory management. The software is also scalable. This makes it easier to grow with your business. Xero is another good option. It provides robust accounting tools. Xero also offers excellent reporting features. These can help with financial planning. FreshBooks may not be the best fit. It lacks some advanced features needed by larger businesses.

Freelancers

FreshBooks is perfect for freelancers. It offers easy invoicing and expense tracking. Time tracking and project management tools are also included. These features are simple to use. QuickBooks can also work for freelancers. It provides more advanced features if needed. These include expense tracking and basic payroll. Xero might be too advanced for freelancers. It offers more features than they usually need.

Frequently Asked Questions

What Are The Main Differences Between Freshbooks, Quickbooks, And Xero?

Freshbooks focuses on invoicing and expense tracking. Quickbooks is known for robust accounting features. Xero excels in payroll and multi-currency support. Each tool has unique strengths.

Which Accounting Software Is Best For Small Businesses?

Quickbooks is often favored for small businesses due to its comprehensive features. Freshbooks is great for freelancers. Xero is ideal for businesses needing payroll and multi-currency support.

Is Freshbooks User-friendly For Beginners?

Yes, Freshbooks is very user-friendly for beginners. Its simple interface and easy navigation make it accessible for non-accountants.

Can Quickbooks Handle Payroll Processing?

Yes, Quickbooks offers robust payroll processing features. It simplifies payroll management, ensuring timely and accurate payments to employees.

Conclusion

Choosing the right accounting software depends on your needs. FreshBooks offers great invoicing features for freelancers. QuickBooks provides robust tools for small businesses. Xero excels in collaboration and integration. Each platform has strengths and weaknesses. Consider your business size, budget, and specific requirements.

Test each with a free trial, if available. This helps you make an informed decision. The right software streamlines your accounting tasks. It also saves time and reduces stress. Choose wisely for your business success.