Navigating the maze of accounting software can be daunting. Freshbooks emerges as a beacon for many.

In today’s fast-paced business world, managing finances efficiently is not just important, it’s essential. Whether you’re a freelancer, a small business owner, or part of a growing enterprise, the right accounting software can make all the difference. For the Accounting Software Solutions enter Freshbooks, a solution that promises to streamline invoicing, expense tracking, and financial reporting.

This software has garnered attention for its user-friendly interface and robust features tailored to simplify the complex world of accounting. In this introduction, we’ll explore why Freshbooks has become a popular choice among professionals seeking to enhance their financial management without getting tangled in the intricacies of accounting jargon. Stay with us as we delve into what makes Freshbooks a worthy contender in the realm of accounting software solutions.

Introduction To Freshbooks

Freshbooks stands out in the cluttered market of accounting software. It simplifies complex financial tasks. Small businesses and freelancers find it user-friendly.

Why Choose Freshbooks?

- Time-saving features automate tasks.

- It’s designed for ease of use.

- Robust reporting tools aid in financial analysis.

- Offers cloud-based accessibility.

- Customer support is exceptional.

Evolution Of Accounting Software

Accounting tools have transformed over time. From manual ledgers to sophisticated software. Freshbooks adapts to the latest industry needs.

| Year | Evolution |

|---|---|

| Pre-2000s | Manual recording |

| Early 2000s | Basic digital tools |

| 2010s | Cloud adoption |

| 2020s | AI integration |

Credit: www.freshbooks.com

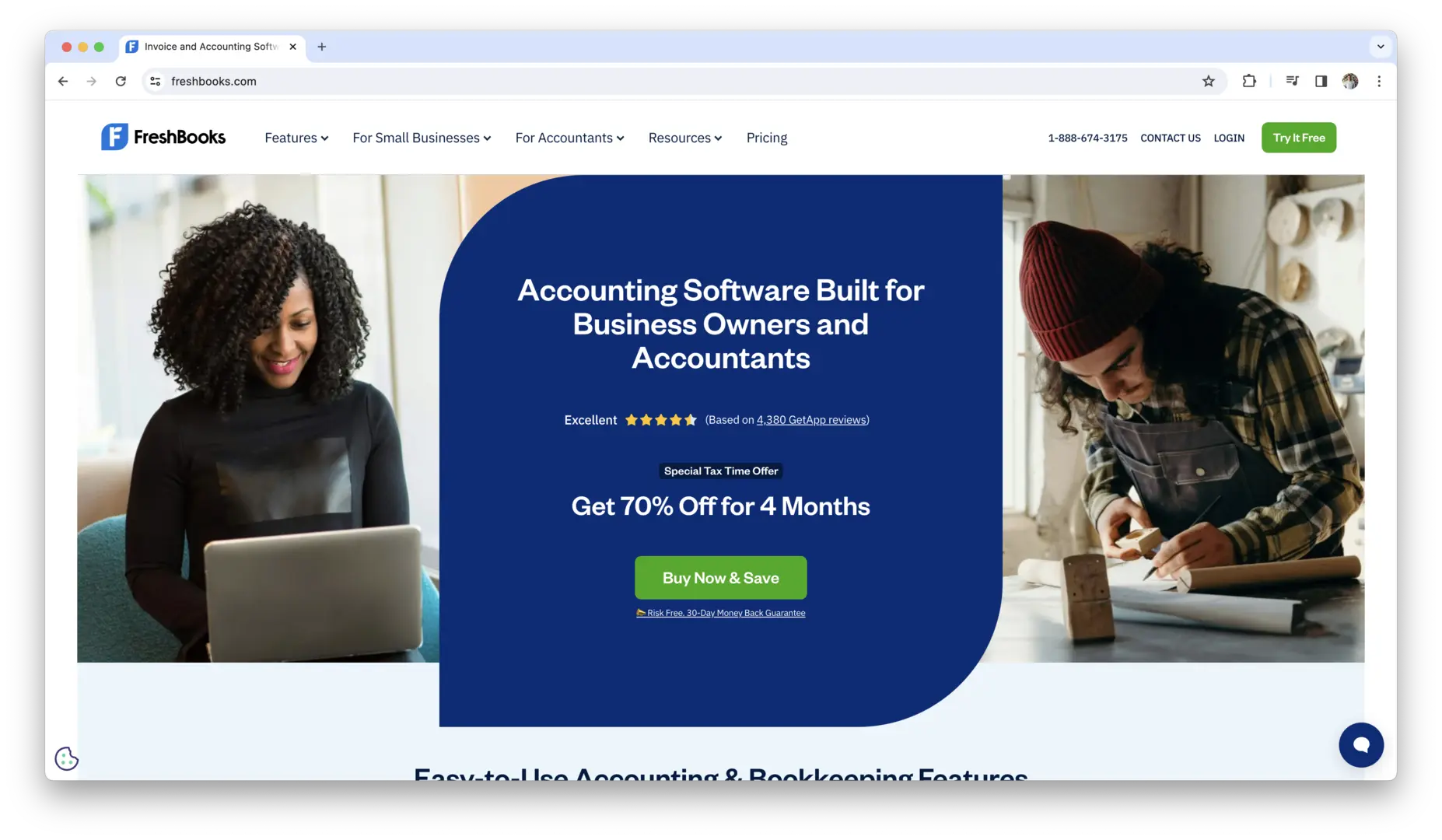

Setting Up Your Freshbooks Account

Setting up your Freshbooks account is easy. It helps you manage money better. You track expenses and send invoices fast. Let’s dive into how to start and adjust your settings.

Getting Started With Freshbooks

First, sign up on the Freshbooks website. Use your email. Choose a strong password. Next, add your business name. Now, your account is ready. You can start using Freshbooks.

Customizing Your Financial Settings

After logging in, go to settings. Here, you can change how things look. Pick your currency and time zone. Also, set up tax rates. This makes billing correct and easy.

Invoicing With Freshbooks

Invoicing with FreshBooks simplifies billing, saving time and stress. This cloud-based solution allows users to craft and manage invoices with ease. FreshBooks provides tools to create clean, professional invoices. It also automates billing for recurring charges. Now, let’s dive into the specifics of these features.

Creating Professional Invoices

FreshBooks offers customizable invoice templates. Users can add logos and color schemes to match their brand. This software makes it easy to add items, set prices, and calculate taxes. Users can also set terms and conditions, ensuring clarity for clients.

Automating Recurring Billing

For regular clients, FreshBooks automates invoice generation. This means invoices send on a schedule without manual input. Users can set up payment reminders and late fees. This feature helps maintain cash flow and reduces overdue payments.

Expense Tracking Features

Keeping track of expenses is crucial for any business. FreshBooks offers robust features to make this process easier. With FreshBooks, users can record expenses quickly and link their financial accounts for seamless management. Let’s explore how these features work.

Simplifying Expense Recording

Recording expenses can be tedious. FreshBooks simplifies it. Just snap a picture of receipts, and FreshBooks does the rest. It reads the details and categorizes each expense. This tool ensures accurate and timely expense tracking, helping businesses stay on top of their spending without manual data entry.

Linking Bank Accounts And Credit Cards

Forget manual updates. FreshBooks connects directly to bank accounts and credit cards. Transactions flow into FreshBooks automatically. This feature saves time and reduces errors. Users enjoy real-time insights into their financials, making it easier to manage cash flow and prepare for tax time.

Time Tracking And Project Management

Managing time and projects is key in business. Freshbooks offers solutions. It helps teams track time and manage projects with ease.

Monitoring Billable Hours

Freshbooks makes tracking billable hours simple. Users start a timer for tasks. This ensures accurate billing. No more guessing.

- Start and stop timer for tasks.

- View hours on any device.

- Bill clients for exact time worked.

Teams see where time goes. They make better decisions.

Managing Projects Efficiently

With Freshbooks, managing projects gets easier. Users see tasks and deadlines in one place. Team collaboration improves.

- Assign tasks to team members.

- Set deadlines and track progress.

- Share files and updates in one spot.

Projects finish on time. Clients are happy.

Reporting And Financial Analysis

Understanding your business’s financial health is crucial. Good accounting software offers robust reporting and financial analysis tools. FreshBooks stands out in this area. Let’s dive into how FreshBooks can help with your financial reporting and analysis.

Generating Financial Reports

FreshBooks simplifies financial report creation. With just a few clicks, users can generate various reports. These are essential for tracking business performance. Below is a list of key reports you can generate:

- Profit and Loss Statements

- Balance Sheets

- Expense Reports

- Tax Summaries

- Invoice Details

Creating these reports is quick and error-free. This saves you time and stress during tax season or when making financial decisions.

Gaining Insights From Analytics

FreshBooks offers valuable insights through its analytics features. Users gain a clear view of their financial status. Here’s how analytics can help:

| Feature | Benefit |

|---|---|

| Dashboard Overview | See key metrics at a glance. |

| Expense Tracking | Understand spending patterns. |

| Time Tracking | Bill accurately for time spent. |

With FreshBooks, small businesses can make informed decisions. They can easily spot trends and adjust strategies accordingly.

Integrations And Add-ons

Businesses thrive on efficiency and smooth workflows. Freshbooks understands this. That’s why it offers robust integrations and add-ons. These tools help you connect with other apps you use. They automate tasks, sync data, and streamline operations. Let’s explore how Freshbooks can extend its functionality and work seamlessly with your existing tools.

Extending Functionality With Apps

Freshbooks’ app store is rich with options. It extends the software’s capabilities. You can find apps for project management, time tracking, and more. Each app connects with Freshbooks in just a few clicks. It’s easy to customize your accounting experience. You tailor it to your business needs.

Seamless Integration With Other Tools

Your favorite tools work well with Freshbooks. This means you can keep using services like PayPal or G Suite. Data flows between them without manual entry. It saves time. Mistakes drop. Your team can focus on what they do best.

Security And Reliability Of Freshbooks

Let’s dive into the Security and Reliability of Freshbooks. These features make Freshbooks a top choice for your accounting needs. We’ll explore how Freshbooks keeps your data safe and ensures the system is always up.

Data Protection Measures

Freshbooks takes your data security seriously. They use strong measures to protect your information.

- Encryption: Freshbooks uses advanced encryption to keep data safe.

- Backups: Regular backups ensure your data is never lost.

- Secure servers: Data is stored on secure, guarded servers.

These steps make sure your information stays safe from threats.

Uptime And Reliability Commitments

Freshbooks promises your service will be reliable. Here’s how:

- 99.9% uptime: This means Freshbooks is almost always available.

- Monitoring: Systems are watched 24/7 to prevent issues.

- Quick fixes: If problems happen, they’re fixed fast.

This commitment means you can always access your data when needed.

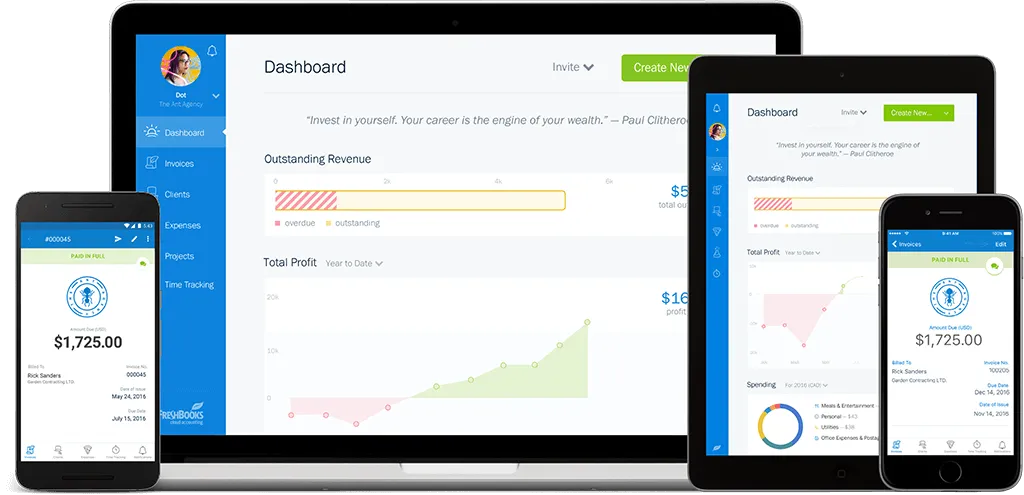

Mobile Accounting With Freshbooks

Keeping track of finances is a breeze with Freshbooks. Mobile accounting lets you manage money anywhere. Busy professionals stay productive outside the office. Freshbooks offers a comprehensive mobile solution.

Managing Finances on the Go

Managing Finances On The Go

Time is money, and Freshbooks knows this well. Their mobile app lets you send invoices, record expenses, and check reports on the move. Stay connected to your business with just a few taps. You’ll never miss a beat, even when you’re away from your desk.

Freshbooks Mobile App Features

Freshbooks Mobile App Features

- Invoice Creation: Send professional invoices directly from your phone.

- Expense Tracking: Snap a photo of receipts to log expenses instantly.

- Time Tracking: Record billable hours as you work.

- Project Management: Collaborate with your team and track project progress.

- Reports: View financial reports to make informed decisions.

With these features, Freshbooks turns your mobile device into a powerful financial tool. It’s designed for those who value efficiency and accuracy.

Customer Support And Resources

Selecting the right accounting software is vital for business success. Freshbooks understands this. They offer robust customer support and learning resources. Users get quick, helpful service and can master the software with ease. Let’s explore how Freshbooks ensures you’re never stuck without help.

Accessing Help And Support

Need help with Freshbooks? Their support team is ready. You can reach them via email, phone, or live chat. They respond fast. You get clear, step-by-step help for any issue. This means less downtime for your business, more productivity.

Learning With Freshbooks Resources

Freshbooks offers many learning tools. They have webinars, videos, and a detailed knowledge base. These resources are designed for easy learning. You can find answers and learn new tricks anytime. This keeps you fluent in managing your finances with Freshbooks.

Pricing Plans And Value For Money

Exploring the pricing plans for accounting software is key. Freshbooks stands out with its value for money. Let’s dive into the packages and their returns.

Comparing Freshbooks Packages

Freshbooks offers a range of plans tailored to various business needs. The options include Lite, Plus, and Premium. Each plan escalates in features and price, fitting different company sizes and budgets. See the breakdown:

| Plan | Price | Clients | Features |

|---|---|---|---|

| Lite | $15/month | 5 | Unlimited invoices, estimates, time tracking |

| Plus | $25/month | 50 | Lite features plus payment reminders, late fees |

| Premium | $50/month | 500 | Plus features plus customized emails, reports |

Assessing The Return On Investment

Investing in Freshbooks can save time and reduce errors. The ROI is seen in:

- Time saved on manual bookkeeping

- Reduced late payments with automated reminders

- Improved cash flow management

Businesses often see a positive ROI quickly with Freshbooks. It’s about choosing the right plan and using its features fully.

Testimonials And Case Studies

Testimonials and Case Studies highlight real-world experiences with FreshBooks. These stories give insights into its effectiveness and impact. They illustrate how FreshBooks streamlines accounting tasks across various industries.

Success Stories From Users

Customer testimonials offer powerful proof of FreshBooks’ benefits. They share stories of time saved, errors reduced, and finances managed better. Let’s explore some success narratives.

- Time-saving: John, a freelance designer, cut invoicing time by 50%.

- Efficiency: Emily, a small business owner, automated expense tracking.

- Profit growth: Alex’s consulting firm saw a 20% profit increase after streamlining workflows.

How Businesses Benefit From Freshbooks

FreshBooks helps businesses in many ways. We’ve compiled key benefits reported by users.

| Benefit | Description |

|---|---|

| User-friendly Interface | Easy to navigate dashboards simplify accounting tasks. |

| Mobile Access | Manage finances on the go with the FreshBooks mobile app. |

| Customer Support | Access to prompt, helpful support enhances user experience. |

Such features lead to better decision-making and improved financial health for businesses.

Making The Decision

Choosing the right accounting software can be a pivotal moment for your business. It streamlines finances, simplifies taxes, and clears clutter. Freshbooks offers a solution, but is it the best fit for your needs? This section guides you through the decision process.

Is Freshbooks Right for You?

Is Freshbooks Right For You?

Business size matters. Freshbooks suits freelancers and small businesses best. Custom invoices, expense tracking, and time management are core features. Need these? Freshbooks could be a match.

Industry-specific needs also play a role. Freshbooks serves many, but not all. Check for compatibility with your niche.

- User-friendly interface

- Cloud-based access

- Third-party app integrations

Consider your team’s tech skill level. Freshbooks is known for its ease of use.

Taking The Next Steps

Ready to try Freshbooks? Start with a free trial. Test the features, upload data, and run your routine tasks.

- Sign up for the trial

- Explore the dashboard

- Customize your settings

Connect with customer support. Ask questions, clarify doubts. Gather feedback from your team. Is the transition smooth? Does it save time? Your answers will shape your decision.

Review pricing plans next. Match them with your budget. Look for hidden costs, like add-ons or integrations.

| Plan | Cost | Features |

|---|---|---|

| Lite | $15/month | Basic functions, 5 clients |

| Plus | $25/month | More features, 50 clients |

Credit: www.10xsheets.com

Credit: www.whizconsulting.net

Frequently Asked Questions

What Is Freshbooks Used For?

Freshbooks is an accounting software designed for small to medium businesses. It simplifies invoicing, expense tracking, and timekeeping, streamlining financial management and reporting.

Can Freshbooks Manage Payroll?

Yes, Freshbooks can manage payroll through integrations with third-party payroll services. This allows seamless payroll processing and financial tracking within the Freshbooks platform.

How Does Freshbooks Handle Taxes?

Freshbooks handles taxes by automatically calculating sales tax on invoices. It also generates detailed tax reports to assist with tax filing and compliance.

Is Freshbooks Suitable For Freelancers?

Absolutely, Freshbooks is ideal for freelancers. Its features cater to the needs of solo entrepreneurs, such as time tracking, project management, and simplified client billing.

Conclusion

Choosing the right accounting software is crucial for any business. Freshbooks makes that choice easy. It’s user-friendly and efficient. Perfect for small business owners, freelancers, and teams. It simplifies invoicing, expense tracking, and time management. Remember, good tools lead to better business management.

Freshbooks could be the smart choice for your accounting needs. Ready to streamline your financial tasks? Give Freshbooks a try. Your accounts can be clearer, and your business, better managed. Let’s make accounting stress-free. With Freshbooks, it’s possible.